Week Two: Space, iPhone, FoW Fundraising, and CPG is SO back

The ISS goes bye-bye, the iPhone 16 Pro is lackluster, Raycast raises a fat sum of money, CPG hits a little spike, and I want a PLAUD NotePin

Housekeeping

Welcome to the second edition of Venture Vantage. We’ll be exploring topics related to tech and the venture ecosystem.

I’ll be trying a new format this week: context & vantage. I’ll start by giving the facts of the case in the “context” section, then provide my thoughts, opinions, and conclusions in the “vantage” section.

As always, please hit me back with feedback and comments—I’m constantly seeking ways to make this newsletter a more valuable read.

Diving right in and keeping things brief:

The Meat & Potatoes

The end of the ISS

Context:

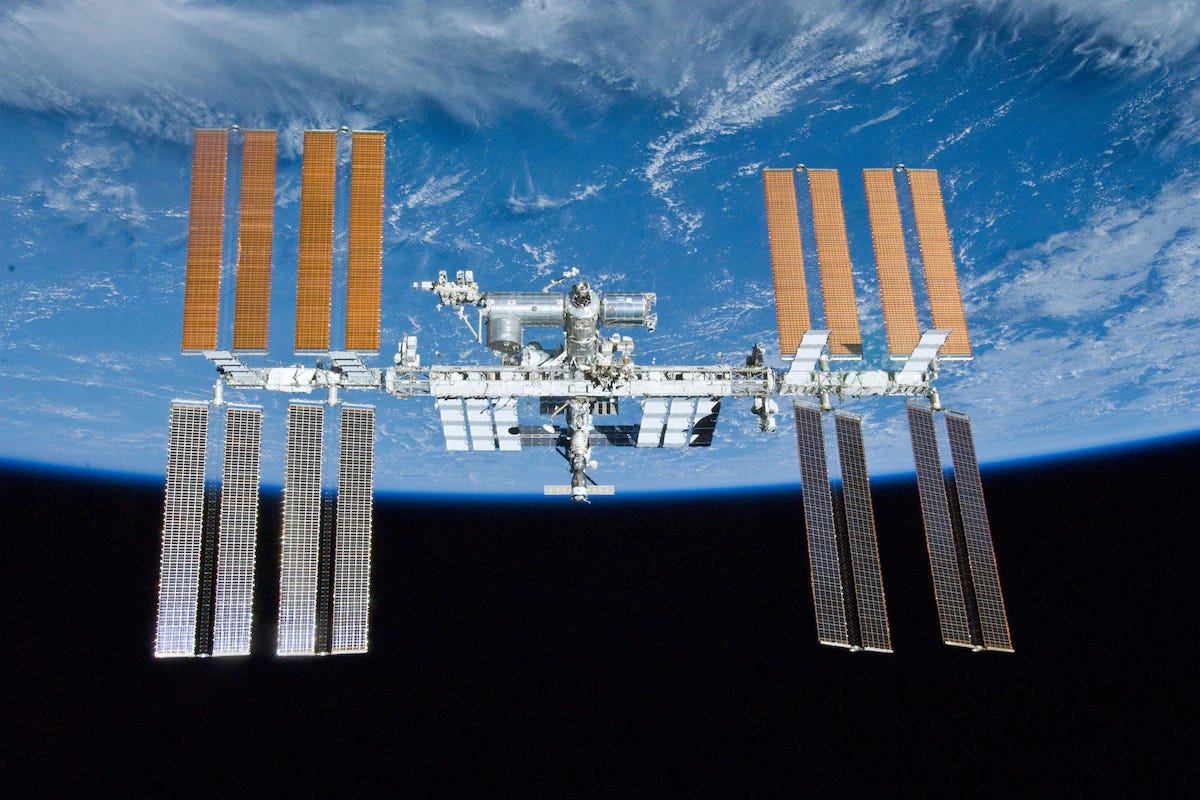

The International Space Station will be decommissioned and destroyed by the year 2030.

Launched in 2000 and owned by five jurisdictions (the US, Russia, EU, Japan, and Canada), the ISS has been continually occupied since then.

Why is the ISS being decommissioned?

Structural issues such as cracks and outdated equipment make maintenance and repair costs more expensive: “the primary structure of the station, such as the crewed modules and the truss structures, cannot be repaired or replaced practically.”

The chance for the ISS to be replaced with a better, more advanced space station.

Roscosmos (Russia’s space agency) wants to exit the partnership and focus on its own space station (uh oh!).

Passing the baton of space stations to the commercial sector rather than leaving it up to the government.

NASA can engage companies like Blue Origin, Nanoracks, Axoim Space, and SpaceX to create Space Station alternatives.

How will it be decommissioned?

The ISS will be lowered into the Earth’s atmosphere with the help of SpaceX. From there, it will burn up, and any remaining debris will fall into the Pacific Ocean.

NASA has already (unsuccessfully) explored options for safely bringing the ISS back to Earth here.

Vantage:

The reasoning for not bringing the ISS to a higher orbit for preservation is that “ascending to these orbits would require the development of new propulsive and tanker vehicles that do not currently exist.”

The piece I didn’t understand is:

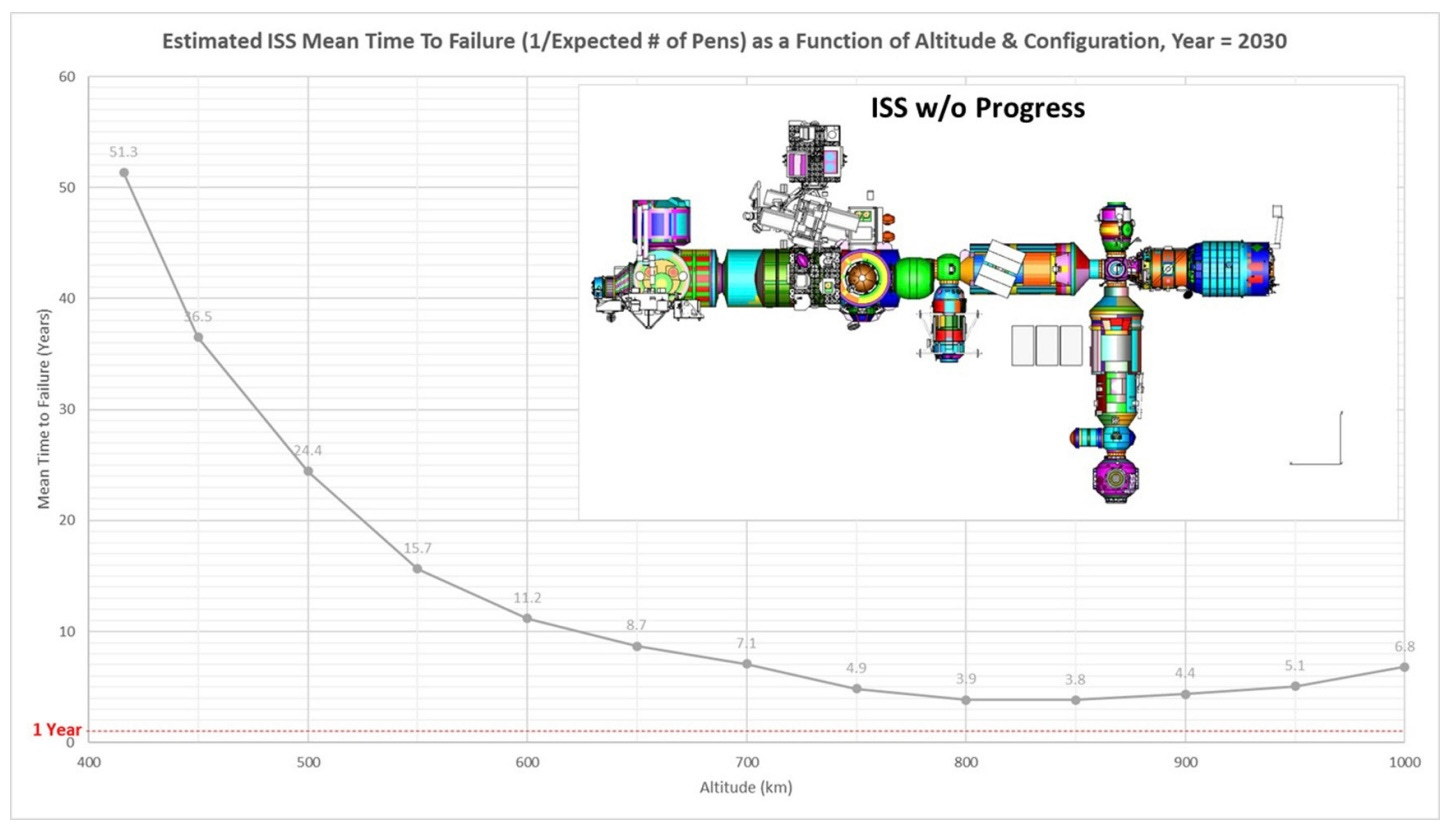

While higher altitudes provide a longer theoretical orbital life, the mean time between an impact event decreases from ~51 years at the current operational altitude to less than four years at a 497 mile (800km), ~700-year orbit.

In my mind, the resources are better left in space for future recycling and study.

There is almost one million pounds of refined metal on the ISS—that’s a major asset to have in space because of how costly it is to transport these refined materials to and from LEO.

Rather than mining resources from the Moon and Mars, why not try to mine from the ISS? Learning to recycle space resources could be incredibly important, given the cost of transportation back and forth from LEO.

If there was a way to keep those resources in space, it could open the door for space startups to build in space at a reduced cost.

Learning to build in space is incredibly important, and leaving the ISS where it is can be an interesting case study for how materials decay and age over long periods in space.

Building in Space

I think technologies that enable us to cheaply erect structures in space will be the next craze. While transportation is undoubtedly important as construction cannot take place without cost and time-efficient transportation, I believe the market for space construction will eclipse transportation as transportation becomes commoditized.

The biggest challenge to space construction today and in the near future is transportation. The two factors to this hurdle are weight and volumetric size.

Last week at the Fast Company Innovation Festival in NYC, I watched Christopher Maurer and Kenny Anderson from Redhouse Architecture present.

They presented their flagship product, which uses mycelium structures as building materials in space. The material can grow to fill gaps in hollow spaces, providing incredible insulation against temperature and radiation. The company is working with NASA to develop prototypes. This can be a really cool deal to keep your eye on. Learn more here.

News, Deals, and Pretty Things

Raycast raises a ton of money

Context:

If you were following my Medium posts, you’d know that I’m a big fan of tools in the productivity/future-of-work space, and that I specifically have an affinity for Raycast.

Raycast is an enhanced replacement for Apple’s macOS built-in Spotlight. It serves as an application launcher, command bar, and multitool for tasks like quick math, AI queries, and definitions.

Since August 2023, I’ve fully replaced Spotlight on macOS with Raycast. It’s amazing and has supercharged my productivity.

TechCrunch just reported Raycast’s $30M Series B led by Atomico.

With this round of fundraising, Raycast aims to add iOS and Windows compatibility.

Vantage:

Venture funding for AI tools is not slowing down.

Raycast coming to iPhone will look very different than Raycast on Mac. It won’t function as an application launcher but instead more like an AI companion. My question becomes: why would anyone use Raycast over Apple Intelligence or the ChatGPT app?

The market for prosumer products is growing. Raycast now has hundreds of thousands of users. While most of them are likely to be free users, it still demonstrates the demand for high-quality productivity tools that replace in-box tools (like Apple’s Spotlight) is growing.

Venture funding is back, and F&B funding is even more back

Context:

This really interesting report was shared with me.

From Q2’23 to Q2’24, there was a 9% increase in venture deal value. 8,247 venture deals were completed, representing $93.4 billion in deal volume.

PE wasn’t as lucky, and instead saw a 22% drop in YoY deal value.

Food & Beverage deals were up 42% in Q2’24 compared to Q1’24.

Consumer discretionary was up 20% YoY, with growing demand for health-conscious products.

Vantage:

As rates dropped last week, we’re likely to see a renewed uptick in valuations.

I think more funds are likely to shift strategies to reap benefits from the health and wellness craze.

While we are extremely conscious of not jumping on hype cycles, the team at Fortify has narrowed our thesis further to focus more deeply on human health.

Go-to-market strategy will grow to become more important than ever. Companies are far too often shooting blind when it comes to health and wellness products, overloading and overstimulating the same small populations of biohacking junkies.

I believe that FoW tools that help provide companies with insights about alternative customer segments to target will do really, really well. Data is the name of the game when it comes to effective GTM and maximizing ROAS, and there’s a lot of money to be made from a B2B angle to help this wave of new health companies compete in less crowded customer segments.

Hopefully, this drop in rates last week will bring back the IPO and M&A markets. The report cited a 308% increase in exit value for venture-backed startups (VBS), but I’m hoping that this number grows even further with rates triggering a higher WTP from buyers.

iPhone 16, one week in

Context:

I got the iPhone 16 Pro just shy of one week ago. I upgraded from the iPhone 14 Pro.

Even with its estimated 37M preorders, the iPhone 16 series is nowhere near the best-selling iPhone.

The biggest changes are the Camera Control button and chip improvements.

I upgraded to have access to Apple Intelligence.

Vantage:

There’s been no substantive difference in functionality or usability from my iPhone 14 Pro to my iPhone 16 Pro.

Apple Intelligence is still too early to be useful or functional.

My advice to those seeking a new iPhone would be to save some cash by getting the iPhone 15 Pro. You get all of the functionality that you get on any of the iPhone 16 models, with nearly identical components.

iPhones have mostly hit their peak; besides massive improvements to battery life or the addition of new sensors, there’s not much that can be improved. Feel free to challenge this by replying to this with what features you’d like your iPhone to have that it is currently lacking.

To me, this signals that it’s time for a new form factor for the same functionality. The rectangular bricks in our pockets are ripe for disruption.

I think the next big trend in the mobile world will be modularity. It will allow for adding more prosumer components, as discussed in last week’s edition. The right-to-repair movement is validating this and seems to be something Apple is doubling down on, as proven by iPhone 16 changes like electric current-activated battery adhesive.

Small tangent: what the actual f*ck, California? The more I write this newsletter, the more I realize that California’s state laws have national implications—and they should not. Between SB-54 for venture diversity reporting, SB-244 for right-to-repair, and Prop 65’s chemical warning, the entire country has to comply with California’s laws if they even want to look in the direction of the most populous state in the country. Don’t even get me started on the AI bill.*

Some cool stuff on my radar

There are a few things that have caught my attention recently, some more exciting than others.

I recently bought an Arcade belt. I hate to be dramatic, but it changed my life. Sitting for hours has become so much more comfortable. I highly recommend it.

I moved my company banking over to Rho last week, and I’ve been loving it. Their expense management platform is so powerful and has made my expense tracking so much easier. I highly recommend it to SMBs.

I’ve been looking for ways to up my video call game. The Insta360 Link has been on my radar for a while, and I figured I’d share it in case anyone wants to try it and let me know how it is.

I am constantly forgetting things. I got the Crush recorder a few months ago, but it hasn’t shipped yet. It’s not looking good, to be honest, but I’ll provide an update if/when it arrives. I’m considering getting the PLAUD NotePin instead. The form factor is much better, and the reputation of PLAUD is great.

Closing

Thanks for reading! Please provide me with honest feedback about how to make this newsletter better. Always looking to cram as much value into the lowest word count possible.

As always, you can find me on X and LinkedIn, and I’d love to hear from you via email. Whether it’s talking startups or just shooting the shit, I’m always happy to connect.

Onto the next!

//Eli