Week Three: Defense tech, wearables, and bullish on snacking

The Iron Dome saves lives, Meta has some cool new sunglasses, I eat my words about Globalstar, and more.

Housekeeping

Welcome to the third edition of Venture Vantage. We’ll be exploring topics related to tech and the venture ecosystem.

We’ll be keeping the context & vantage format. The feedback received has been positive.

As always, please hit me back with feedback and comments—I’m constantly seeking ways to make this newsletter a more valuable read.

Diving right in and keeping things brief:

The Meat & Potatoes

Iron Dome to the rescue

Context:

Four days ago, Israel killed Hassan Nasrallah, the leader of the barbaric terror group Hezbollah. Nasrallah is directly responsible for the death of more than 241 American service members, and hundreds, if not thousands, of Israelis.

Less than 24 hours ago, on Tuesday, Iran launched at least 180 ballistic missiles at Israel as retaliation for the strike killing Nasrallah. This was the largest ballistic missile attack in history, ever.

The attacks killed only one Palestinian man—a massive failure for Iran.

The Iron Dome marked a massive advancement in defense tech since its development in 2011. From 2011 to today, the US has contributed over $2 billion to the development and implementation of the Iron Dome. Much of that has been spent back on US contractors. The government is the best customer of defense tech.

The Iron Dome was developed by Rafael Advanced Defense Systems in collaboration with Raytheon. Elements of tech from the Iron Dome have been integrated into US weapons systems like IFPC, the Patriot missile defense system, THAAD, and Aegis.

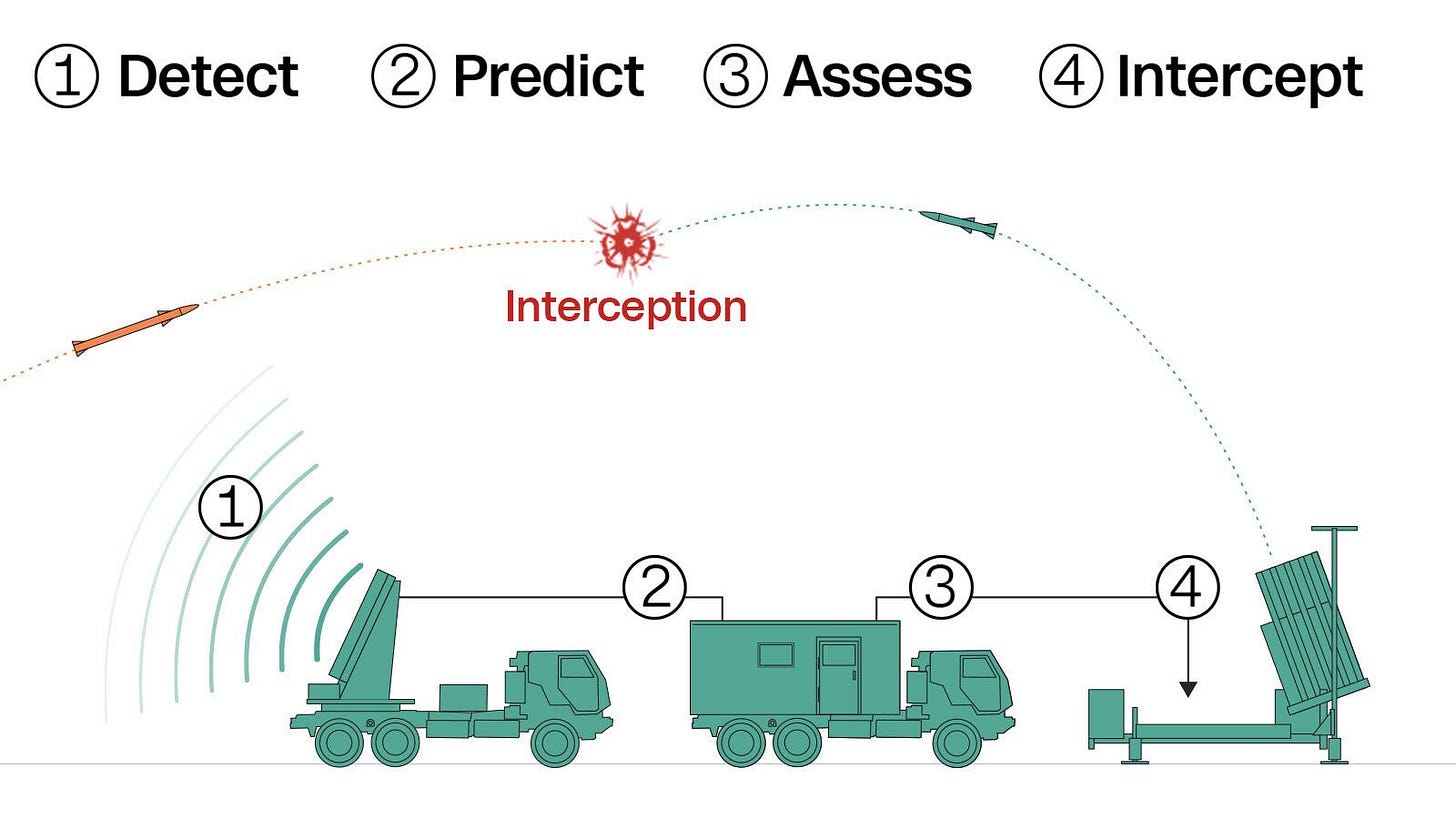

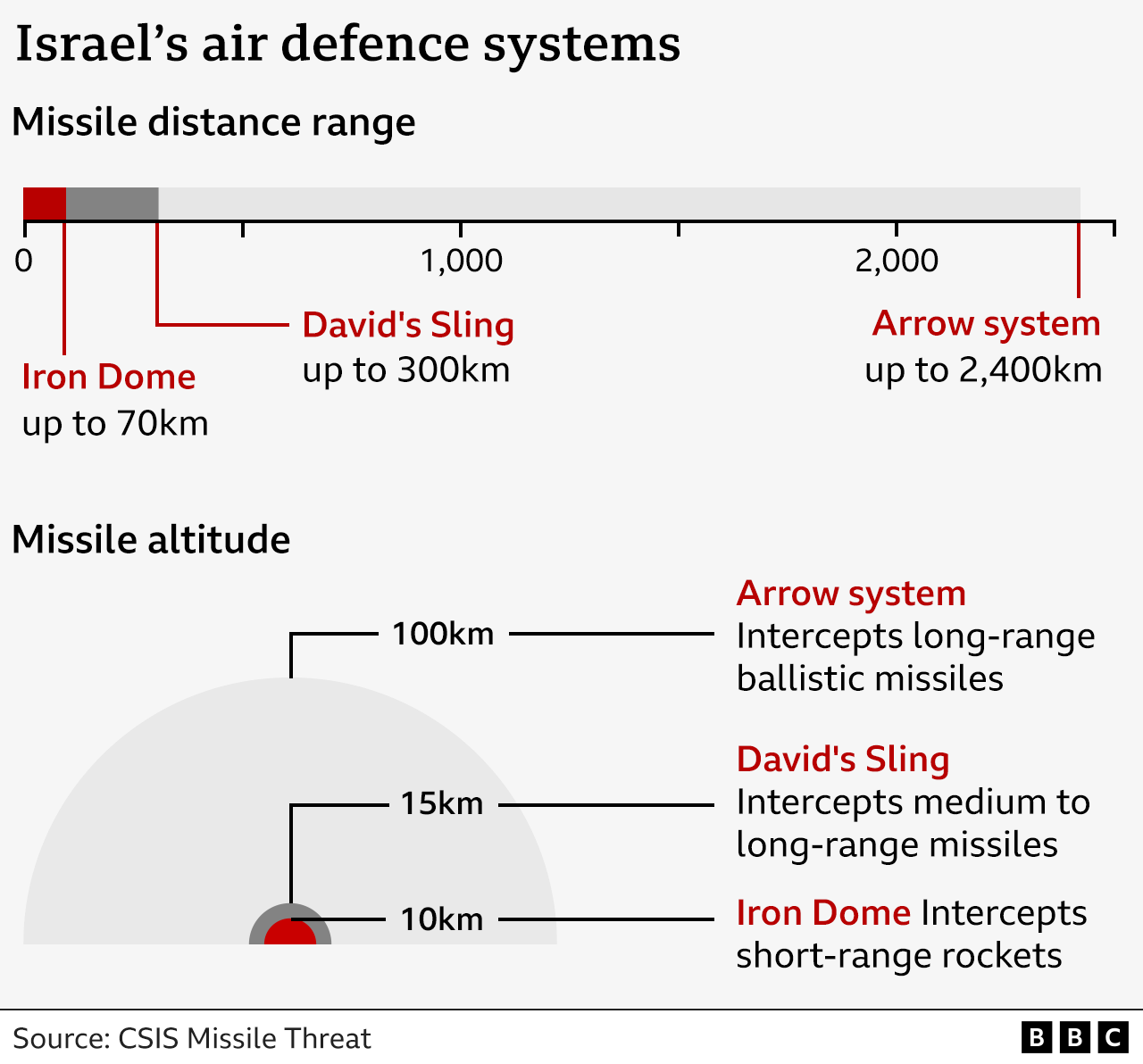

The Iron Dome works by detecting and tracking incoming rockets or missiles, calculating when they will be at high altitude and not over populated areas, then firing a projectile to intercept and destroy incoming rockets. The Iron Dome has over a 90% success rate, having stopped tens of thousands of rockets in the last year alone.

The Iron Dome, however, is used to stop short-range missiles. Israel has two beefed-up versions of the Iron Dome called David’s Sling and Arrow 2/3, which are used to intercept longer-range missiles, like those from Iran’s attack.

Vantage:

There are billions of dollars of government money behind the development of new and innovative lifesaving defense technologies. The Iron Dome is a great example of what the future of defense could look like, especially against unsophisticated militaries like Iran and their proxies.

The future of warfare is technological—replacing boots on the ground with targeted and accurate unmanned weapons. There will need to be new innovators in the space (startups) to aid in the development of these weapons.

About a month ago, we saw Y Combinator back their first defense tech company, Ares Industries. This is a big deal, marking a shift for YC. I am confident that defense tech will be a growing sector.

Fortify Ventures is really bullish on innovative defense technologies. We are confident that over the next few years, there will be some incredible technologies that help protect the lives of innocent civilians, both at home and abroad, while allowing us to provide substantial returns to our LPs.

Sunglasses just got cool again

Context:

At this year’s Meta Connect (about a week ago), Zuckerberg announced the new Orion glasses. The Orion glasses are Meta’s newest development in the space of augmented reality, aimed to compete with Apple’s Vision Pro but in a much smaller form factor.

The glasses are jam-packed with innovations, from new display tech to new eye tracking tech. Orion doesn’t use a screen and instead uses a projector in the arms of the glasses that shoot light into waveguides. All very, very cool stuff.

Vantage:

We’ve seen AI come in almost every form factor over the last few years. From familiar form factors like the Ray-Ban Meta Glasses to the Rabbit R1, and even more unfamiliar form factors like the Humane AI Pin to Limitless or the PLAUD NotePin we discussed last week. This seems to be Meta’s clear preference for eyewear.

What stands out about eyewear is that it has a remarkable vantage point for data collection. Sitting high on the body with close access to the face, it is uniquely positioned to capture plenty of data about the user and their surroundings. Additionally, glasses are one step closer to our (arguably) two most rich sensory inputs: sound and sight.

There are so many incredible startups that I think have real potential to be threats to giants like Meta. The most promising in my eyes (pun intended) is a company I met about a year ago, that has asked to remain nameless. The company has the ability to measure high-resolution facial activations, monitoring everything from attention and mood to chewing patterns and even mental health diagnoses. This just proves that there is lots of innovation left in the health-based wearables space, with lots of new tech that could be attractive for the big players to acquire.

I think there’s a massive gap growing in the market for truly innovative wearables that a) collect unique data beyond HRV and sleep stages and b) serve a practical function in the productivity of our daily lives. The biggest issue with wearables today is that they are not actionable and don’t provide any benefits with relation to how we go about our day.

Take Oura or Whoop, for example. Waking up and seeing your sleep score does very little to actually change the course of your day. You might slightly modify your workout based on what you see, but I’d argue that the data only ever hurts.

At the end of your day, your movement data is displayed as strain, stress, steps, time in motion, etc. Very little transparency is given around how this data was collected or what it means.

Both Oura and Whoop collect the same data, just in different form factors. There is no super special or proprietary data source to either of them or their competitors.

One of the biggest problems about the status quo of wearables is that the data is not actionable. It very rarely gives you specific, tailored instructions to improve your scores. For example, Whoop will tell you that consistent sleep times are key to good recovery, but won’t give you data like “going to bed 15 mins earlier can boost your recovery score by 8%.”

The last problem with the status quo of health-focused wearables is that they often lack practical functionality. Garmin and Apple have been focused on changing this by making a “Swiss army knife” wearable, but even then, most of the features tend to be a gimmick for most. A wearable that measurably improves productivity because it is an invaluable tool is the next decacorn in the space.

Satellites can save lives

I’ll keep this one short, as I hate saying I was wrong.

Context:

Hurricane Helene did a lot of damage. Over 170 people have died as a result, roads are shut down, and over 1 million people in Georgia, South Carolina, and North Carolina are still without power.

Cell phone outages have hit, with thousands left without access to communication.

T-Mobile tried to set up mobile connectivity terminals to restore access, but it hasn’t been entirely effective.

Starlink even launched a Hurricane Helene Relief program to help restore connectivity for those in need.

Vantage:

Funny enough, what ended up being hugely helpful for lots of people to check in with family is the satellite messaging feature in iOS 18.

As clogged as the Globalstar network has become since Apple onboarded all their new devices, it is still an effective tool for cellular-less communication.

Emergency infrastructure is an already massive industry and is growing rapidly. So much of the infrastructure has been B2B or B2G (business to government) oriented, but I am confident that the B2C market is huge and hugely underserved.

Products like the Garmin inReach line are the only thing comparable to Apple’s satellite messaging, but even then, the inReach line is certainly more prosumer.

There is a lot of money to be made for startups that help address the largest symptoms of natural disasters, or provide security, safety, and comfort for those affected by them.

News, Deals, and Pretty Things

OpenAI’s 2x valuation

Context:

OpenAI just raised another $6.6 billion today, valuing the company at $157 billion.

That’s a double in valuation in under one year.

The company saw roughly $5 billion in losses this year, with only $3.7 billion in revenue.

The leadership team at OpenAI is leaving—Mira Murati, Bob McGrew, and Barret Zoph all left/are leaving soon.

Vantage:

I’m honestly puzzled how funds like Thrive Capital expect to provide a return to LPs. How likely is a successful IPO with this valuation? What is OpenAI’s path to profitability?

Big money for chips

Context:

PepsiCo is buying Siete Foods, the healthy, grain-free tortilla chip company, for $1.2 billion.

Siete is available in over 40,000 doors across the country, with a variety of product offerings from tortillas to salsas, and sauces to cookies. They are one of the biggest brands in the better-for-you food space.

Their cap table was star-studded with names like Eva Longoria.

Vantage:

Better-for-you foods may not be that much better for you, but they certainly are here to stay. These big deals cement these healthy alternative snacks into the fabric of the American diet.

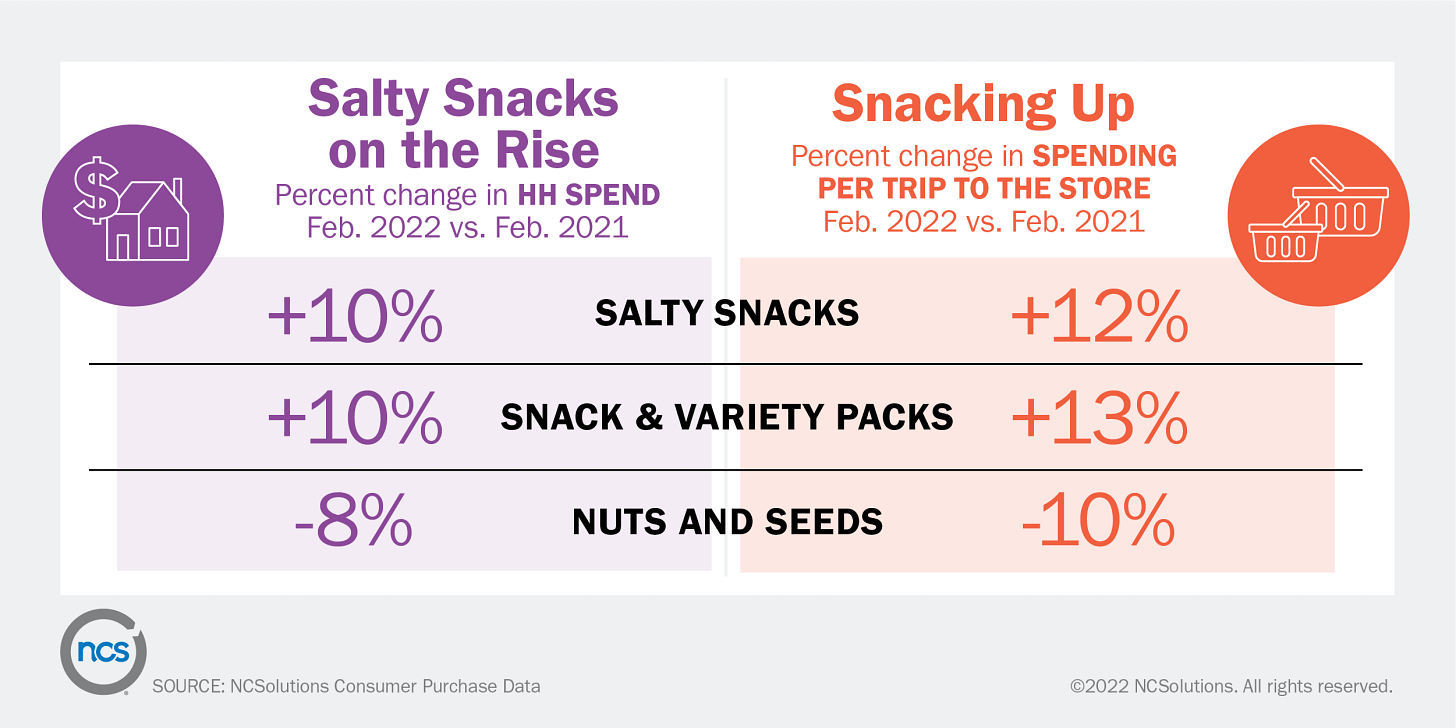

Snacking is majorly up. If there was a snacking index fund, I’d dump all my money into it.

As discussed in Week One, the biggest threat to snacking is Ozempic. What is incredible to me is that nuts and seeds (arguably the healthiest snack) are down, while ultra-processed snacks are up. Consumer taste for fresh, natural foods is dropping while health-consciousness is growing.

The Expo West-style-CPG-better-for-you-BS snack foods is undoubtedly growing. There is a massive opportunity to make money in the space with high-quality foods that are truly good for you, filling the gap that exists in a lot of food deserts across the country.

More FSD

Context:

Waymo, the Google-owned self-driving taxi company, just launched in Austin, TX.

This is Waymo’s fifth city where they are now operating.

Waymo completed 15,000 rides in Los Angeles from December 2023 to March 2024. That number has only grown since.

Vantage:

It’ll be interesting to see what this does to companies like Uber and Lyft.

FSD companies are operating at a much higher risk than rideshare companies. GM’s Cruise was ordered a few days ago to pay $1.5M in federal fines, after having their FSD license suspended earlier this year.

I’m curious to see how venture funds respond to this. It’s a big regulatory risk for an industry that already has razor-thin margins. Uber took 15 years to become profitable, and they don’t even have a hardware component.

No cool stuff this week!

I haven’t seen anything that has caught my eye. A weird, weird week for me.

Closing

Thanks for taking time out of your Wednesday to read. Shana Tova, may you be in for a good year.

As always, you can find me on X and LinkedIn, and I’d love to hear from you via email. Whether it’s talking startups or just shooting the shit, I’m always happy to connect.

Onto the next!

//Eli