Housekeeping

Welcome to the thirteenth edition of Venture Vantage. We’ll be exploring topics related to tech and the venture ecosystem.

To all my NYC friends: it’s time to move to LA. 82° and sunny today, with not a cloud in the sky.

Short edition this week, been hustling to close out Fortify’s biggest deal yet.

As always, please hit me back with feedback and comments—I’m constantly seeking ways to make this newsletter a more valuable read.

Diving right in and keeping things brief:

News, Deals, and Pretty Things

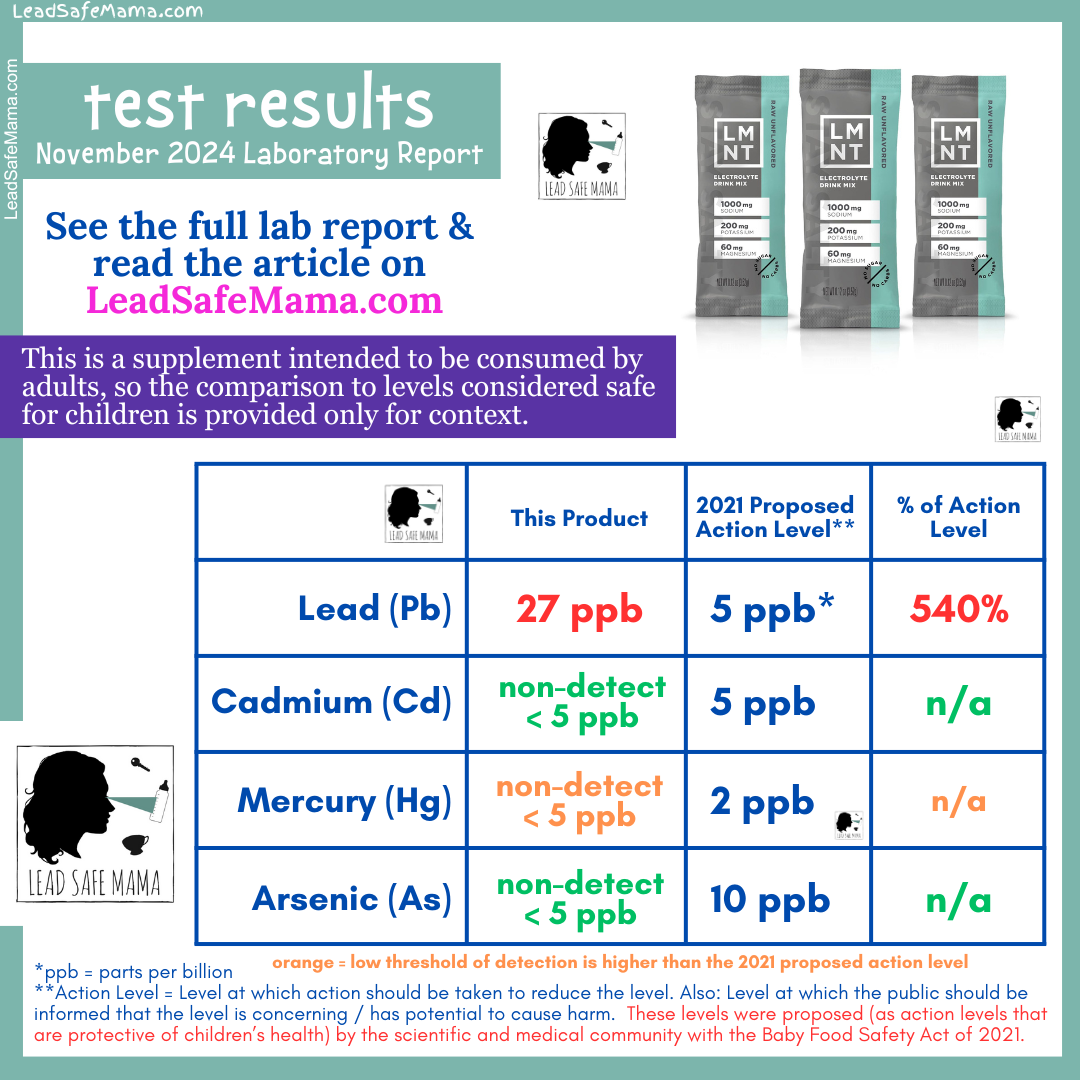

LMNT might kill a baby…maybe?

Context:

According to Tamara Rubin’s latest report, the Raw Unflavored version of LMNT electrolytes that they tested had higher-than-safe-for-children amounts of lead.

Heavy metals, unlike vitamins, accumulate in the body over time. This means that your body can’t effectively rid itself of heavy metal consumption, so the levels in your body will just grow over time.

Heavy metals are given two “caps” for heavy metals in products: action levels are numbers that companies should strongly try to stay under, and maximum allowable levels are legally enforceable limits set by the FDA.

The FDA allows for maximum allowable levels (MAL) of up to 10 ppb for apple juice, and 20 ppb for other juices. LMNT, despite it not being a juice, would sit over that limit. This might not be such a big deal, though, because the MAL for candy is 100 ppb.

Vantage:

LMNT is one of the brands that has taken off in the Huberman-fueled health and wellness movement. They provide packets of electrolytes that contain 1,000 mg of sodium, double that of Liquid IV and nearly quadruple that of Gatorade.

According to LMNT’s Form C-AR filing for 2024, the last SAFE they issued was at a $200M cap. It doesn’t say how long ago that SAFE was issued, but I assume it was quite a while ago since they did $206M in gross revenue in 2023 alone. The company must be worth a fortune.

It’ll be really interesting to see how much these (no offense to Lead Safe Mama) smaller organizations can influence sales with their lab testing and findings. This will be a good litmus test for how many health and wellness consumers actually care about the health benefits, as compared to the illusion of feeling healthy in a more performative manner.

Another murder this week: NVIDIA killed competitors

Context:

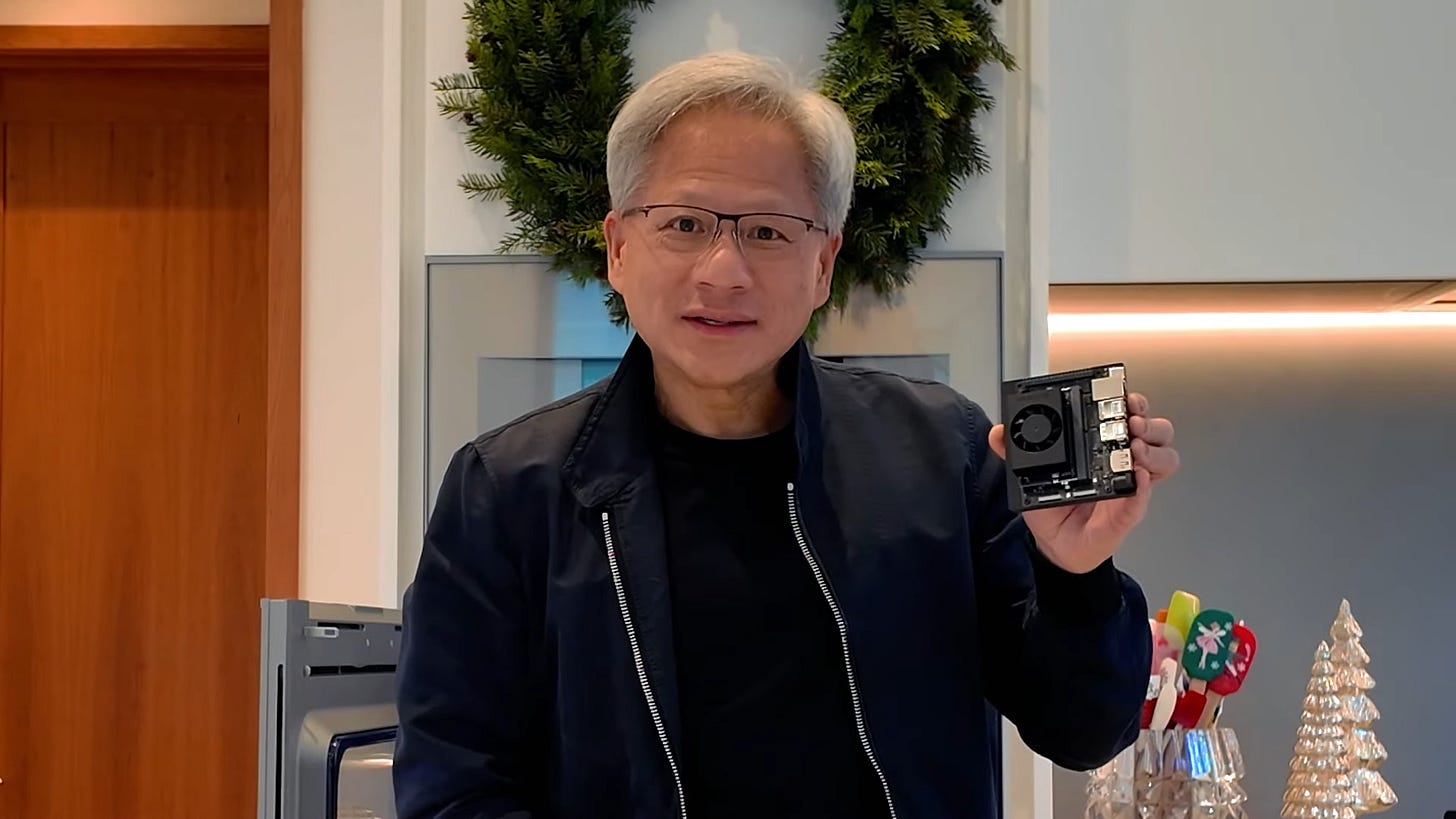

NVIDIA just announced their latest mini supercomputer for generative AI: the Jetson Orin Nano Super. Wow, that’s a name. Watch out, Simon Bolivar (whose real name is Simón José Antonio de la Santísima Trinidad Bolívar y Ponte Palacios y Blanco), NVIDIA is coming for you!

The palm-sized computer boasts 70 trillion operations per second (TOPS) with 25W, priced at $250. At nearly twice the TOPS of a new Mac Mini, it’s meant to be an easy and affordable option for everything from advanced robotics to generative AI.

The Nano Super can run Meta’s Llama 3.2 LLM at 21 tokens per second and only drawing 25W; it’s super power efficient.

Vantage:

There is no doubt in my mind that NVIDIA is absolutely murdering competitors. I would be so amazed if anyone can actually compete with the quality-to-price ratio (value) and rapid innovation that NVIDIA is spitting out.

This is a massive door to new opportunities for AI startups. It just made the entry point to AI hardware cheaper and more powerful, in turn making it more accessible for earlier-stage startups.

I think we’ll see a lot of new startups using AI in innovative ways since they can affordably handle on-board computing. AI home robots coming soon!

Endowment tax might go up

Context:

The Trump administration is debating hiking the university endowment tax from 1.4% to 35%.

Endowments are often some of the biggest LPs in venture funds. In 2020, Yale had 22% of their $41B endowment invested in venture.

Straight from USC’s 2019 report:

The University of Southern California's (USC) endowment includes a venture capital program that invests in newly formed companies, primarily in the technology sector. The venture capital program is the endowment's best-performing asset class, generating an annualized return of 18.8% over 10 years.

Vantage:

This shot at one of VC’s biggest LPs could mean trouble for the ecosystem as a whole. Often acting as anchors alongside pension funds and fund-of-funds, endowments end up fueling tons of early-stage tech innovation.

This can also mean trouble on the university-level. Many universities invest in student or professor run startups through vehicles funded largely or wholly by the endowment fund. If these funds drop in size, it can also decrease on-campus innovation.

Deals that caught my eye

Here’s the latest and greatest:

Databricks raised an additional $8.6B from Thrive Capital, Andreessen Horowitz, DST Global, GIC and Insight Partners, putting it at a $62B valuation. It desperately needs an IPO soon to give some liquidity to investors, but who knows when markets will be “ready.”

Grammarly bought Coda, a Notion-competing productivity tool. The price was not disclosed, but Coda’s last valuation was $1.4B at its Series D in 2021. Coda’s founder, Shishir Mehrotra, will now become Grammarly’s CEO.

LA-based Salt AI raised a $3M seed round led by Morpheus Ventures with participation from Struck Capital, and Irregular Expressions to build out a workflow orchestration tool.

Kleiner spinout G2 Venture Partners is raising a $750M Fund III. Wow, that’s big.

A big one one coming soon :)

Rapid Fire

Context: Masayoshi Son of SoftBank pledged to invest $100B into US projects over the next four years. Trump tried to use a bit of peer pressure to get him to double the amount, but seems like it didn’t stick. | Vantage: This could mean a lot of money flowing downstream to early-stage tech companies. Crunchbase reports $126B has been invested in early-stage venture (TTM), which means that even 10% of the $100B from SoftBank going into early-stage tech could make a big difference to the ecosystem.

Context: Temu was the most downloaded app on the Apple App Store for the second year in a row. | Vantage: This could really mean trouble for American e-commerce businesses. Will startups have to pivot to adapt to the increasingly Chinese-centric marketplaces? This will surely have a massive effect.

Context: The WSJ is reporting that Meta asked California Attorney General Rob Bonta to block OpenAI’s planned conversion from a nonprofit organization to a for-profit company. | Vantage: People in the ecosystem (from Elon Musk to Mark Zuckerberg) are unhappy about OpenAI’s growing dominance. Steps will be taken to put a stop to them, opening the door for early-stage competitors to steal some market share.

Context: Another OpenAI employee who became a critic of the company was found dead. | Vantage: I am NOT saying murder, but that is the theme of this week’s VV…

White Hot

No White Hot section this week… my mind has been occupied with closing out Fortify’s biggest deal ever, and that’s all I can think about at the moment. I’ll leave you with this, though: defense tech to quickly identify if something is a bird, drone, UFO, or hallucination.

Some cool stuff on my radar

I love good coffee. I love cool ways to make good coffee. I especially love good deals. Ergo, I must love this Alessi Moka Pot. It’s a great deal for a high quality product—excited to give it a try once it arrives this week.

I know this sounds really silly, but I’m adding this refurbished iPhone to the list this week. Why? Because having what I call a “dirty phone” has entirely changed my productivity and response time. I put all the distractions and annoying apps on one phone (Instagram, Netflix, YouTube, WhatsApp, etc.) and keep my regular phone as “clean” as possible. That way, when my regular phone buzzes, I know it’s something that actually needs my attention. I leave the dirty phone at home when going out, helping me feel a lot more present. When I am vegging my brain at home, my regular phone can be charging. It’s the greatest hack no one talks about.

Continuing from last week… I’ve been looking for a fancy wine opener, and this L’Atelier one is really awesome. I’ve tried a few so far, and this feels like the best value for a premium corkscrew. Another honorable mention is the Craighill Wine Key.

A cool one: the IUTD Reusable Film Camera. I’ve been on the hunt for a reusable film camera that isn’t too complex but still high quality, and this looks like the pretty clear winner.

Continued Reads

This week’s continued read is Essentialism by Greg McKeown. It’s about removing the bullshit from your life to maximize the things that actually yield a return. A snippet:

“The executive followed the advice! He made a daily commitment towards cutting out the red tape. He began saying no…He stopped sitting in on the weekly update call because he didn’t need the information. He stopped attending meetings on his calendar if he didn’t have a direct contribution to make.”

Read it here.

Closing

Thanks for taking time out of your Wednesday to read.

As always, you can find me on X and LinkedIn, and I’d love to hear from you via email. Whether it’s talking startups or just shooting the shit, I’m always happy to connect.

Onto the next!

//Eli