Week Fourteen: Oh, how I've missed you.

As a result of President Trump's efforts, Venture Vantage is back in the U.S.!

Housekeeping

Hey ;) it’s been a minute. Welcome to the fourteenth edition of Venture Vantage. We’ll be exploring topics related to tech and the venture ecosystem.

I apologize for the brief hiatus—Christmas, then New Years, straight into the LA fires. It’s been a wild time, but the momentum behind VV has only grown. It’s awesome to see the texts & emails of people asking what happened to weekly VV. Rest assured, we’re back to our regular scheduled programming (assuming no more freak natural disasters take place).

I would be remiss if I didn’t start off by acknowledging the incredible loss my community has suffered. Whether you live in LA or not, please consider doing your part to help repair the incredible damage that the Pacific Palisades has sustained as a result of these fires. Whether it’s donating to a family’s GoFundMe, donating belongings you don’t need anymore, or helping assist in the cleanup, no effort is too small.

Walking past the Palisades Barber Shop on Antioch etched this quote in my brain, always reminding me that :

If you’re rich, you live in Beverly Hills.

If you’re famous, you live in Malibu.

If you’re lucky, you live in the Pacific Palisades.

As always, please hit me back with feedback and comments—I’m constantly seeking ways to make this newsletter a more valuable read.

Diving right in and keeping things brief:

News, Deals, and Pretty Things

Latest & Greatest:

New section here. Will give you a quick summary of what has been top of mind for me recently.

Distilled Intelligence is going to be so epic. We’re beginning to think through programming, sponsors, and event logistics. The branding is looking so, so good. If you’re interested in coming as a founder or investor, add your email here.

Always looking to connect with great founders & funds. If we haven’t connected in a while (or ever) reply to this email or shoot me a LinkedIn message.

Been super busy fundraising for Fund II. We’re lucky to have had some great momentum so far. Always happy to connect about that, too, if you have someone you think might be a good fit for the fund.

Norovirus is really scary. Pro tip: Vitamin A (best in Cod Liver Oil) can help make sure your symptoms are more mild—start taking it today!

TikTok goes dark… and then live again. But probably dark again, too.

Context:

ByteDance, a Chinese company founded in 2012 by Zhang Yiming, is the parent company & owner of TikTok after it merged with the app Musical.ly.

There have been broad efforts since TikTok gained popularity to ban the platform over privacy & data concerns. It has been banned from being downloaded onto the devices of federal employees and servicemembers for quite some time.

On April 24th, 2024, Biden signed a bill that would finally require ByteDance to sell TikTok by January 19, 2025, or face a ban. No substantial effort was made by ByteDance to sell the American side of TikTok.

On January 10th of this year, the Supreme Court heard arguments about why ByteDance shouldn’t be forced to sell TikTok, but ruled on the 17th that they would uphold the ban.

On January 18th, TikTok went dark, citing the Biden bill for the deactivation of the platform. On the 19th, it promised to restore its service because of an executive action proposed by Trump.

On January 20th, Trump signs an executive order, delaying the ban enforcement by 75 days, giving ByteDance until April 4, 2025, to divest.

Vantage:

It’ll be very interesting to see if ByteDance starts to take the threats of a shutdown seriously, forcing them to sell TikTok no matter at how large of a discount, or if they think they can continue to negotiate their way to maintaining ownership & control.

Following all of this, there have been reports that Instagram is trying to poach TikTok’s creators, promising them bonuses in the range of $10,000 to $50,000 per month to create content for Instagram Reels. The goal is for them to steal away TikTok’s top creators in a moment of weakness.

Some folks, like Bill Ford at General Atlantic, think TikTok will be sold to a US company soon.

CES Highlights

Context:

CES is the Consumer Electronics Show, first started in 1967. Since then, it’s been a place to showcase innovation and unveil new products. When you work in tech, you’re missing out if you’re not there (I was not there this year, in case you were wondering).

Vantage:

At CES, Uber and Delta announced their new partnership, replacing Delta’s previous partnership with Lyft. The partnership will allow Uber users to earn Delta SkyMiles with each ride and delivery order, starting in the spring of this year.

Delta is also getting some 4K HDR screens for its planes, which in my opinion is a much-needed improvement. Air travel entertainment sucks, as does in-flight WiFi.

Random tangent, but Delta actually won the WSJ’s “best airline of the year” award. I couldn’t disagree more, but clearly the WSJ knows something I don’t.

Robotics seemed to be a pretty hot topic at CES this year. From robot vacuums to humanoids, it seems like (and Jenson Huang agrees) that the next big developments in AI will be related to robotics.

I think there were not enough products & companies embracing the “right to repair” or modularity movement this year at CES. I think there is so much potential for change in the consumer tech industry with this movement, and we need manufacturers to step up to the plate to embrace it.

Smart glasses seemed to be pretty prominent this year, with some great demos from companies like Rokid. I’m telling you—I’m long glasses.

It seems like my prediction was right: prosumer modularity for your phone seems to be a growing market, and companies are catering to that market need with things 2TB drives (from makers like SanDisk and ShiftCam).

Stargate: AI for America!

Context:

OpenAI, SoftBank Group, and Oracle formed a $500 billion joint venture, called Stargate, focused on building AI infrastructure in the U.S., with $100 billion deployed immediately.

The project aims to create over 100,000 U.S. jobs, with backing from high-profile leaders: OpenAI CEO Sam Altman, SoftBank CEO Masayoshi Son, and Oracle founder Larry Ellison.

President Trump is the one driving this project, formally announcing it yesterday (Jan 21).

Vantage:

Stargate is a signal that the big players in the space are going all-in on AI infrastructure, and it’s going to shake things up for startups: startups chasing infrastructure or compute might struggle to compete unless they’re ultra-niche or solving a pain point Stargate can’t touch.

This move shows OpenAI doubling down on grabbing the compute it needs and breaking free, while leaning on SoftBank’s cash and Oracle’s tech muscle.

This hints that OpenAI wasn’t happy with how slow or limited Microsoft’s cloud services were for its needs, so it switched to Oracle. This shows there’s a gap in the market for cloud solutions that can deliver speed, efficiency, or cost-effectiveness at scale. Startups that can fill that gap—offering something better or more tailored for AI workloads—could become funding or acquisition targets.

With 100,000 jobs on the horizon, hiring in AI is about to get even more cutthroat. Startups will need really positive and infectious culture or mission-driven momentum to steal top talent from giants. Or honestly… founders giving up a ton of equity to early employees might work, too.

Elon Musk was quick to bash the project, doubting its ability to succeed. Why? My bet is because of his beef with Sam Altman.

Rapid Fire

Context: Netflix just surpassed 300 million users, with 19 million new members added last quarter. | Vantage: With this milestone in paid users, Netflix also raised their price by 10%. This shows that streaming isn’t quite as “over” as people might have thought—it’s just being consolidated into the big players.

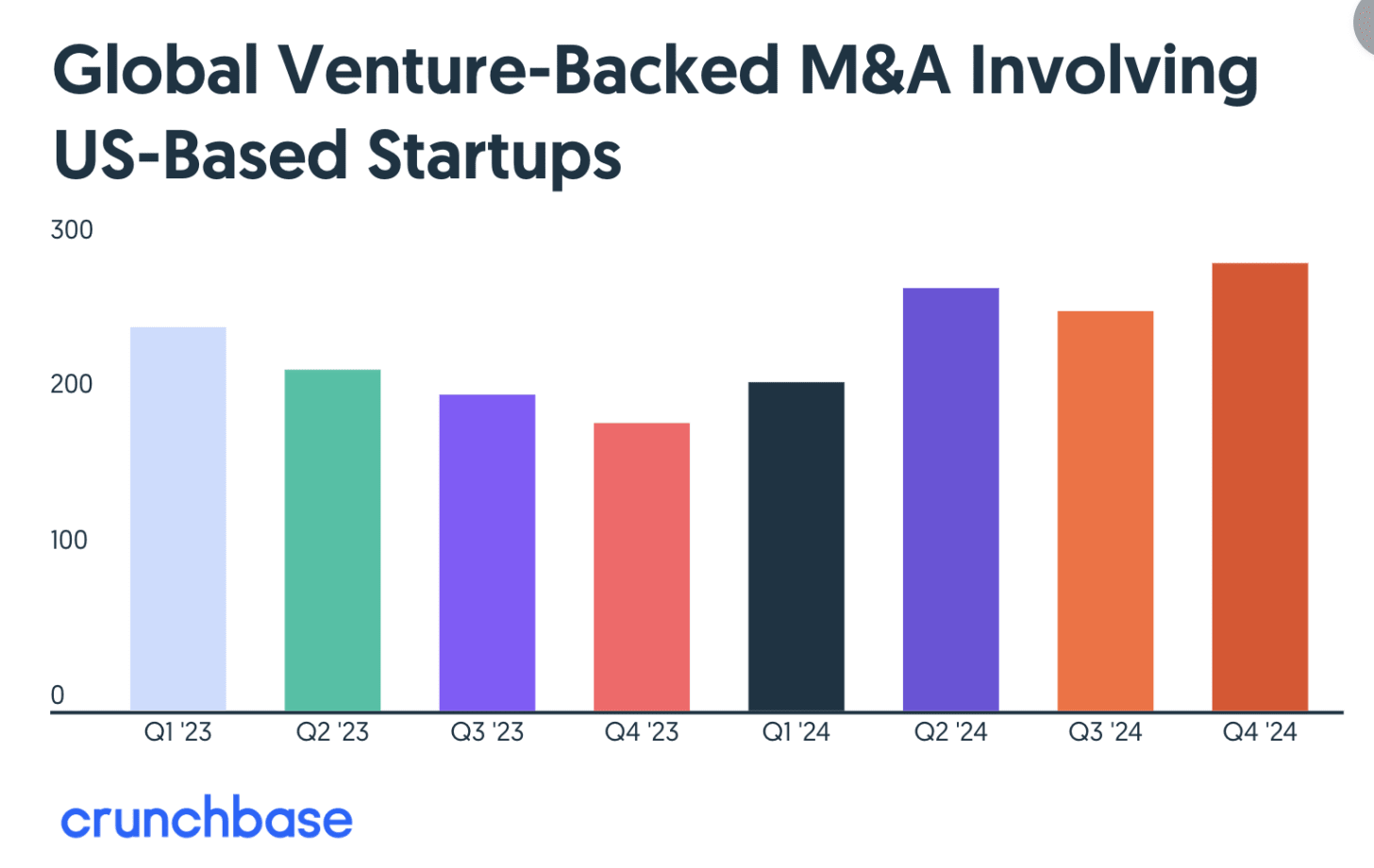

Context: Crunchbase is reporting that venture-backed startup M&A was up to 289 deals last quarter, making it the highest quarter in 2 years. Also, VC funding in 2024 edged up to $314 billion, with AI leading the charge, taking nearly a third of the total. | Vantage: Seems like markets are becoming increasingly friendly to VC again. I just hope we don’t start hitting valuation bubbles like we did during COVID, and things stay sane throughout this period of growth.

Context: Apparently Perplexity wants to merge with TikTok?? Apparently they submitted a bid for it. | Vantage: Perplexity AI sees the merger with TikTok as a chance to supercharge its AI capabilities by leveraging TikTok’s user base and behavioral data, creating a feedback loop for smarter, more personalized AI products.

Deals that caught my eye

Here’s the latest and greatest:

Baton closed a $10M Series A led by Obvious Ventures with participation from Burst Capital, FJ Labs, Fluent Ventures, Spencer Rascoff via 75 & Sunny, Divergent Capital, Bloomberg Beta, and Zeno Ventures. Pretty stacked cap table, if you ask me.

Leap, a data-forward retail leasing platform, raised $20M from Tribeca Venture Partners and DNX Ventures.

Guidesly, a booking platform for outdoor adventures backed by Aspen Capital Group, YETI Capital, HalfCourt Ventures, and Derive Ventures, just raised a $9.5M round to accelerate it’s vertical AI offerings.

Nilus, an AI-powered treasury management solution, raised an additional $10M from Felicis and Vesey Ventures and Bessemer. This actually looks like a deal I would totally be into.

Teal Health might be my favorite company I have seen in a while. This is a deal I am really upset I missed in my sourcing pipeline. They just closed a $10M seed round from Emerson Collective, Forerunner, Serena Ventures, Metrodora, and Labcorp to bring at-home cervical cancer screening to market.

White Hot

Human Health:

I am just realizing how big of an impediment the cold is to outdoor based workouts. I was always bullish on Zwift, but I truly believe there will have to be more Zwift-like solutions for team & group activities.

Advanced air filtration systems.

Future of Work:

There has to be a platform that makes it easy to find people based on criteria. LinkedIn is so full of spam and garbage, that you have no idea who is legit and who isn’t. Imagine a Yelp-like platform where people got verifications and reviews. Using the same approach that data companies like PitchBook use for companies and applying it to people, harvesting verified data. With an AI integration, you could say, “I am looking for a venture fund that will lead my seed round and help me actually raise money.” The platform would then recommend Eli at Fortify (the appropriate person on the team) since they have verified that Eli actually does this. The founder could then rate their interaction with Eli or report if he was a total douchebag.

Infrastructure:

This feels moronic to say, but there needs to be some serious innovation in the fireproofing space. Whether it’s for homes, or art, or cars, people need to start creating systems to prevent catastrophes like those in LA over the last few weeks.

Some cool stuff on my radar

This is so incredibly dorky, but I have been LOVING the new Shokz OpenMeet. They were recently released at CES 2025, and they have been a game changer in the office for me. I can hear those around me freely, people on calls can hear me better (mic is 10x better than AirPods), and they are SO comfortable. Shokz, pls sponsor me:

I have decided to buy about 3.2 million of these Osprey pouches—they are so lightweight and practical for everything. I use 4 in my gym bag (wet clothes, clean clothes, shampoo/soap, and toiletries), 3 in my backpack (cables), 2 for my travel bag, etc. You’ll fall in love, I promise.

Been loving my Parker Vector Rollerball as my pocket pen the last few weeks. Deep carry clip, super lightweight, and cheap enough that I won’t cry if I lose it. 5 stars, highly recommend.

My favorite trail running shoe (that I also use for hiking) is on sale right now. $99 for the Asics Trabuco Max 3. The highlighter color is cool, I promise.

Just generally, I’ve been on a supplement tear thanks to feedback from Vitality Blueprint. It’s really a game changing platform, I cannot recommend it enough. Also, been using Zest, which has been pretty good.

Been loving the Kiehl’s Facial Fuel to keep my face from cracking in this frigid NYC weather.

Icing on the Cake

Continued Reads

This week’s continued read is Ryan Roddy’s newsletter. It’s a great place to learn more about optimizing your health. A snippet:

From his 2025 Predictions: “Neurotechnology will move into the mainstream with devices like wearable neuromodulation headsets and patches designed to regulate stress, improve sleep, and enhance cognitive performance. Affordable home-based neurofeedback systems will also empower users to monitor and adjust brain activity without needing clinical support.”

I couldn’t agree more. Read it here.

Word of the Week

I’ve decided to start a new section: Word of the Week. I’ll be highlighting a term commonly used in venture capital or the entrepreneuerial space in an effort to help you decode this newsletter and sound pro when talking about startups.

This week’s word is:

PortCo: an abbreviation for portfolio company, meaning a company that a venture capital or private equity firm has invested in.

The suffix “Co,” short for company, can also be added to other prefixes. NewCo is used to refer to a new company someone is starting, HoldCo is used to refer to a holding company, OpCo means operating company, DevCo, SpinCo, TopCo, the list goes on and on.

Closing

Thanks for taking time out of your Wednesday to read.

As always, you can find me on X and LinkedIn, and I’d love to hear from you via email. Whether it’s talking startups or just shooting the shit, I’m always happy to connect.

Onto the next!

//Eli