Introduction

Ladies and gentlemen, welcome to the first edition of Venture Vantage. I am a big fan of Smart Brevity, so I’ll do my best to keep my newsletters as short as humanly possible, and use outline format wherever possible.

About Venture Vantage:

Published every Wednesday.

Insights, deep dives, reflections, suggestions, reflections, rants, and musings related to all things venture:

Interesting areas of investment

New products in the world of tech

Productivity tools

Platforms for fund ops

Cool deals I’ve seen that Fortify can’t participate in

& more

Brief, easy to digest, and as short as possible.

A mish-mash of topics, often all over the place.

The Meat & Potatoes

iPhone 16 Launch & Consumer AI

Diving right into it: iPhone 16 launches on Friday. It’s incredibly mediocre from an innovation perspective. The biggest addition: Apple Intelligence. Now some factual context:

First-weekend pre-orders for the iPhone 16s were 12.7% lower than the iPhone 15s. 37 million devices across the iPhone 16 line were sold.

Apple Intelligence, Apple’s new onboard AI, is only compatible with iPhone 15 and 16 models.

Estimates suggest that roughly 70 million iPhone 15 variants have been sold in the US thus far.

Apple has roughly 60% market share in the US. Only roughly half of their US customers will have access to Apple Intelligence when it launches in October. That’s roughly 30% of the US that will have access to Apple Intelligence.

So, what does this mean for startups?

Most consumer tech startups building apps are optimizing for iOS nowadays. However, roughly half of iPhone users in the US have a device too old to run Apple Intelligence.

People care less about having access to the newest AI features than manufacturers think; for most, the ChatGPT app is plenty (it’s been downloaded 110 million times in the US as of April 2024).

This should be a massive warning to consumer tech startups: the masses are happy to add AI into their life when it’s convenient and accessible, but they won’t go out of their way to cram AI into their lives.

All of this, to me, is a signal that consumer-facing AI doesn’t have as big of a demand as many in the venture community would have hoped.

People want AI to meet them where they currently are in their tech journey rather than having to switch devices and habits to accommodate new implementations of AI.

CA’s SB54 Expectations

SB54 is not news, but it has been a conversation at Fortify over the last week, so I think it’s worth talking about.

In 2023, California’s State Senate passed SB54 titled “Venture capital companies: reporting.” This is a big, big deal for venture funds all around the country.

The bill officially commences on March 1, 2025. We’re less than six months out.

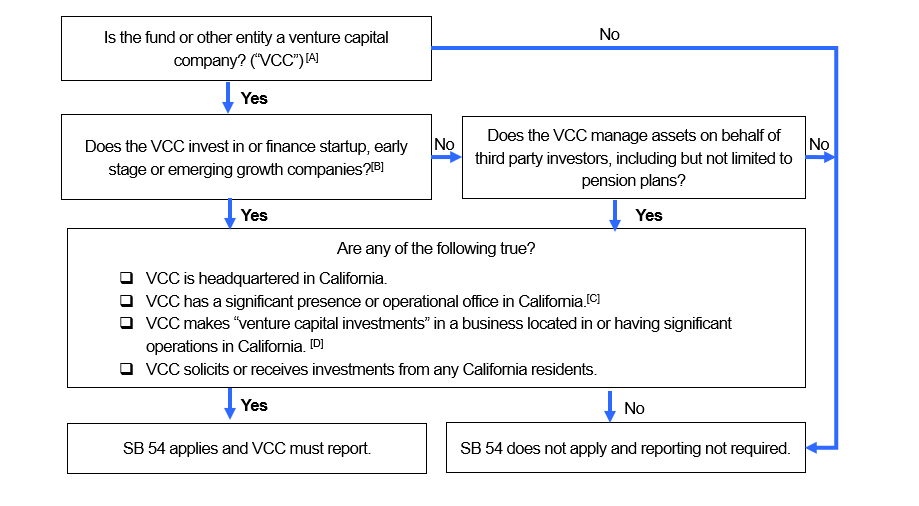

See the below graphic from Gibson Dunn about who the bill applies to:

To me, the thing in the bill that will trigger the most people to comply is if they are an ERA dealing with early-stage companies.

My guess: most venture funds in the US will be subject to SB54. I mean, what venture fund has no portcos in CA or no LPs in CA?

Okay, so it applies to a ton of venture funds. What does SB54 actually mean and do?

SB54 requires fund managers to report the diversity stats of the founding teams they invest in.

Founding teams include anyone who owned initial shares, contributed to the development of the business before the issuance of shares, or someone who isn’t a passive investor. So does that mean incubators or accelerators are considered “founders” in this bill??

Fund managers will have to collect data about the race, ethnicity, LGBT status, gender identity, disability status, veteran status, and CA resident status of its founders and report it to the state.

Enforcement will be in the hands of the California Civil Rights Department (CRD).

Funds have within 60 days of the March 1 start date to file the report.

Here are the real kickers:

The fund must also report the dollar amount of its portfolio company investments and the principal place of business of each portco.

The CRD may publish this anonymized information online.

The CRD can collect fees for the “administration of SB54.”

If founders fail to provide the information when asked, however, the venture funds can “fail to report” with no punishment.

Now here’s the problem: The CRD is supposed to provide a form to venture funds so that they can submit this data. However, no form has been released yet by the CRD, so venture funds currently have no idea what to expect.

If venture funds fail to comply, the CRD can take them to court, and levy fines for the “amount necessary to ensure compliance” relative to the fund’s size, AUM, and reason for noncompliance.

My question: will this push venture funds and venture funding out of CA? Will venture funds dissuade companies from being headquartered or having operations in CA, and will venture funds avoid CA based LPs, all to avoid having to comply with SB54? Could be bad news for CA’s tech ecosystem if this happens.

What you read here is not legal advice, just my thoughts and questions about the new bill. I’m not an attorney (thank G-d).

News, Deals, and Pretty Things

Search Funds & Secondaries: It sounds like secondaries are on the rise, according to Crunchbase. To me, this screams opportunity. I suspect we’ll see a bunch of venture & private equity fund managers begin to do what I like to call the pocket-swap:

A lot of venture fund managers will soon start a search fund for secondaries.

Buy secondaries from early-stage funds, maybe even from your own fund or your friends, for 60 cents on the dollar.

The venture funds are happy because TVPI just got turned into very necessary DPI, even if it marked down their numbers a bit.

Hold stock in a business that has no real path to exit.

Try to take control of the business, turning it into a healthy lifestyle business that kicks out good dividends.

If you succeed, there will be enough cash flow to make LPs happy, and you’ll go on to raise more funds.

If you fail, you’re in the same position you were in before (no DPI ability), and LPs still hate you.

Of course, this is all predicated on the assumption that LPs don’t hate their fund managers too much for the lack of DPI and are still willing to invest with them.

WSJ Goes AI: The Wall Street Journal launched an AI chatbot earlier this week to help make a news post about iPhone 16s more interactive. I’d be so curious to see how many people used it. Check it out here.

Bad News for Fast Food & Snacks: Axios Pro was talking about a weight loss startup called Ahara, which is pushing drugs like Ozempic.

Here’s my take: Ozempic is a massive, massive threat to fast food and especialy convenience stores and snack brands.

I was sitting at Kazu Nori a little while ago talking to a couple in their mid-30s. They were both on Ozempic.

The husband was telling me how it’s the best financial decision they’ve ever made: they’ve cut their spending on food by nearly half since starting Ozempic.

Some of that reduction has come from smaller portions at restaurants, but most of that reduction has come from not buying snacks anymore.

New Leica: Leica just released the M11-D, a brand new screen-less digital camera. It uses old school dials, relying mostly on one’s phone for control. Damn, it’s beautiful. To me, this marks another step forward in the thesis that traditionally standalone tech products are just becoming accessories tethered to your phone. Seeing as how so many content creators are using phones for recording, editing, etc., I am majorly bullish on products that enable users to extract pro features from their phones.

Easy Fiber Supplement: ZBiotics just released their Sugar-to-Fiber product, helping convert excess sugar in the gut to healthy and helpful fiber. This is some cool, cool stuff. It has the potential to shift the entire gut-health industry, and I could totally see companies like AG1 hopping on the fiber wave created by ZBiotics to help bring them back into the spotlight.

Get a Desk Pen: I’ve started keeping this pen on my desk along with a Post-It dispenser, and it’s been such a game changer. I’ve started writing down small things that I am too lazy or rushed to put into Todoist. The pen has flat sides so it won’t roll of your desk, which is incredibly underrated. Give it a try.

Closing

This is my first real newsletter, so please bear with me and the growing pains. Friends are awesome, but they give dishonest feedback when solicited. Leaving comments with things you like or don’t like about that week’s newsletter would be incredibly helpful for me to improve quality.

As always, you can find me on X and LinkedIn, and I’d love to hear from you via email. Whether it’s talking startups or just shooting the shit, I’m always happy to connect.

Onto the next!

//Eli